If you are a beginning investor or are just starting out on your financial journey than this book might be for you. Andrew breaks down investing into really easy steps that anyone can accomplish. He discusses saving, doing taxes, stock markets, simple tax strategies and makes the entire process digestible. This is the common sense investment book that explains complex things very simply and in a funny way.

A Penny Saved is Two Pennies Earned

Ultimately, this book is a strong advocate for the minimal lifestyle and living below your means. This foundation is great for the average person, and probably good advice for the majority of people. I'm torn with this viewpoint here because Andrew's focus here is strictly on living below your means. If you make $100/day than you better be spending less than $100/day. There is no discussion on how you can raise that $100/day to $200/day.

The most important point here is that if you save a penny you will ultimately save two because of the taxes and withholdings that occur as a normal employee. If you make $15/hour than you will end up taking home about $10. This means that in order to save $15 you would need to work an extra half an hour (1.5 hours total) in order to bring $15 home. This concept is heavily discussed because it is a lot easier to save that money rather than spend it and have to work double in order to get that money again.

The concept also rolls into the investing world as well. A penny invested now is going to be worth a lot more in the future than if you spend it. Overall, I liked this concept as a fundamental principle, but the rule that I like following is to raise your means rather than strictly live below your means.

Hot Tips and Quick Wins Don't Exist

Fundamentally, this is a principle that everyone should realize. That hot tip you heard from your friend most likely isn't that hot. Your broker most likely doesn't know what he's talking about. That salesman is just trying to get your money rather than make you rich. The point here is that the new and upcoming wealth vehicle is most likely not new by the time you hear about it.

Andrew discusses how ultimately you need to do your own research if you are going to jump into the stock market game. No one has a more vested interest in your money than you and most people actually don't care if you lose it all. This principle is important because it teaches you to always think about what is motivating any other party. Salesman ultimately want to sell you something. Of course they would love it if their product actually worked, but if it doesn't they don't care that much. Brokers ultimately want to keep your money in their accounts and they make money on any trades that you do. This might be a good reason to give you insider tips on where to invest, but really as long as you make a trade they make money. Doesn't matter if the stock goes up or down.

The point is, do your own research if you are going to play that game. If you hear about some hot tip, there is certainty it's not that hot anymore and you have to understand the motivation behind whomever is telling you about this hot tip.

Teach Your Family While They're Young

There is a section in the book discussing how to get your kids to understand the principles illustrated and how to teach them without being too complicated. I really liked the analogies Andrew makes with compound interest and how if each child saves their money each day they will make interest on their money and by the end of a month, they will have a lot more. It's a good exercise that I would like to try on my kids when they are older.

This section also discusses how to treat the topic of money within your family and with your spouse and other dependents. It also gives you a good path if you inherit a ton of money from one of your family members. Ultimately, the sell here is that if you don't know what to do with your money than put it in a low cost index fund.

Pros/Cons

The pros to this book are that the book is easy to understand and easy to listen to. Andrew does a great job breaking down the fundamentals of investing into bite-sized actionable things you can do. He also explains it such that after hearing what he is saying you'll say "duh, of course that's what I should do."

The cons are that this book is very much focused on the mindset of stay below your means. Of course, that is an important point, but ultimately I'm looking for books that help me raise my means. This book doesn't have much in this department as it's focused on the average person.

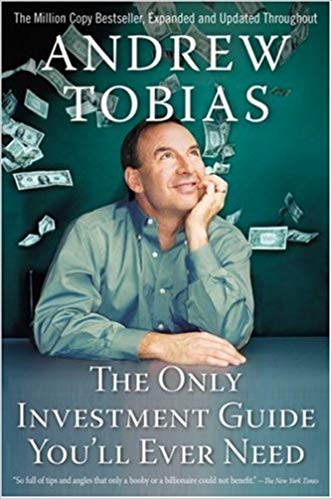

The Only Investment Guide You'll Ever Need by Andrew TobiasConclusion

I enjoyed listening to this book. I thought it was simple and Andrew does a great job illustrating basic financial points in a funny manner. If you are brand new to the investing world than I think this book might be for you. If you are a constant spender and don't understand why it's important to save than this book will do a good job illustrating why it's important.

Other books like this one might be The Richest Man in Babylon by George S. Clason or Dave Ramsey's Total Money Makeover. Both of these books deal with saving your money and how saving what little you might have and investing in the long run will work out for you.

This book gets a seven out of ten because it was funny and engaging and your learned the basics of financial literacy, but it wasn't groundbreaking and I didn't have any "aha" moments that would help me on my financial journey. I did end up buying from a case lot sale recently, which Andrew mentions at the beginning of the book, so I guess there's that.

CkeePLWHupAGFRvKHpwjNfw

reply